Two Indian government officials have told Reuters that India is currently considering spending an additional Rs 2 trillion ($26 billion) during the 2022-23 fiscal year, to safeguard consumers from rising prices and fight multi-year high inflation. The new amount is double the Rs 1 trillion hit government revenues could take from tax cuts on petrol and diesel. On May 21, a series of changes to the tax structure levied on crucial commodities was announced by Finance Minister Nirmala Sitharaman. There will also be a cut in excise duty on petrol by Rs 8 rupees ($0.1028) per litre, and Rs 6 per litre on diesel. The finance minister, in a series of tweets, announced that the new tax regime on petrol and diesel could result in a loss of about Rs 1 trillion to the government in annual revenue due to lower collection.

The two officials also told Reuters that the Indian government has estimated that another Rs 500 billion will be needed to subsidise fertilisers, in addition to the current estimate of Rs 2.15 trillion. Another round of tax cuts on petrol and diesel is likely if crude oil continues to rise, which could mean an added hit of Rs 1-1.5 trillion during this fiscal year. The government may also need to borrow an additional sum from the market to fund these measures, which could mean a deviation from its deficit target of 6.4 percent GDP for 2022-23. Currently, the government plans to borrow a record Rs 14.31 trillion during this fiscal year, as per budget announcements made in February. One of the officials said that the additional borrowing will not impact the planned April-September lending of Rs 8.45 trillion, and may be undertaken during January-March 2023.

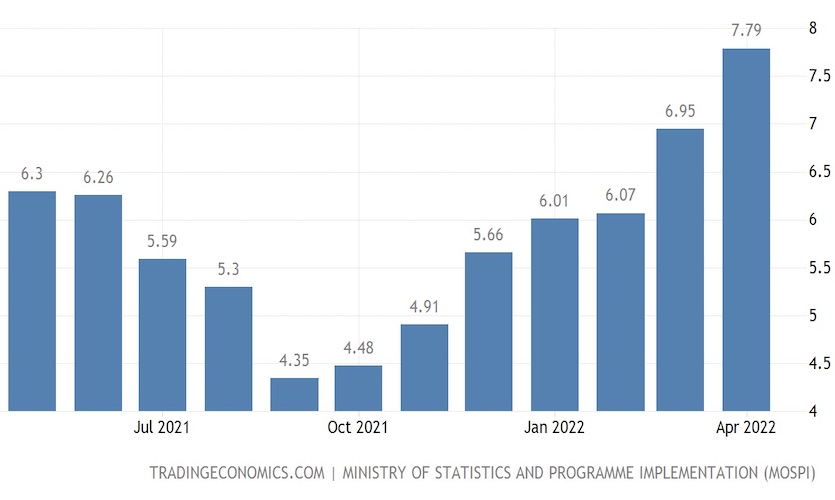

India witnessed its retail inflation rise to an eight-year high in April, while wholesale inflation rose to at least a 17-year high, which could pose an issue for Prime Minister Narendra Modi’s government ahead of elections in several state assemblies this year. “We are fully focussed on bringing down inflation. The impact of the Ukraine crisis was worse than anyone’s imagination,” said one of the officials who did not want to be named.

The ongoing heatwave across many regions of India could also potentially exacerbate inflation and hurt growth, as informed by the Moody’s Investors Service on May 23. It further stated that in the long term, India’s highly harmful credit exposure to physical climate risks will impact its economic growth. Making the region more volatile as it faces increasing, and more extreme incidences of climate-related shocks, the rating agency recognised that heat waves are fairly common in India and usually occur in May and June. However, New Delhi witnessed its fifth heatwave in May, with temperatures reaching as high as 49ºC. “The prolonged high temperatures, which are affecting much of the country’s northwest, will curb wheat production and could lead to extended power outages, exacerbating already high inflation and hurting growth, a credit negative,” said Moody’s. Global wheat prices have also jumped 47 percent due to the Russian invasion of Ukraine in late February. The estimate of wheat production has also been revised by the government by 5.4 percent, to 105 million tonnes for the crop year ending June 2022, given lower yields amid higher temperatures. “The lower production, and fears that a surge in exports to capitalise on high global wheat prices would add to inflationary pressures domestically, has prompted the government to ban the export of wheat and to divert it toward local consumption instead. Although the move will partially offset inflationary pressures, it will hurt exports and subsequently, growth. “The ban comes at a time when India, the world’s second-largest wheat producer, could have been capitalising on the global output gap from wheat following the Russia-Ukraine military conflict,” marked Moody’s.

Read more: World Bank Slashes India’s Growth Forecast For 2022-23

All items from fuel to vegetables and cooking oil, pushed wholesale price inflation to a record high of 15.08 percent in April, and retail inflation to a nearly eight-year high of 7.79 percent. The ongoing threat of inflation has led the Reserve Bank of India to hold an unscheduled meeting to raise the benchmark interest rate by 40 basis points, to 4.40 percent, earlier this month.

“Inflation will be partially alleviated by keeping wheat production for domestic consumption and the cap in power prices in exchanges, as well as the Reserve Bank of India’s 40-basis-point policy rate rise in early May. However, given the prominence of cereals and food more generally in India’s consumption, elevated food prices could add to social risks if they persist,” said Moody’s.